Recent Indian Policy Initiatives in Lead Battery Scrap Management and their Impact on

the domestic Demand-Supply Gap of Lead

Dr. V. Rajagopalan

Joint Secretary

Ministry of Environment & Forests India

the domestic Demand-Supply Gap of Lead

Dr. V. Rajagopalan

Joint Secretary

Ministry of Environment & Forests India

1 . Supply-Demand of lead scrap in India

- Of the global lead mine production of 4,54,000 MT in the year 2000, India’s share was merely 1%. The production of lead in India from primary sources accounts for nearly two thirds of the total lead production in the country whereas, the world over, the production from secondary smelters accounts for nearly 60% of the total production of lead.

- The production of lead in India has almost remained static during the last ten years. However, during the same period, the demand has more than doubled and this has led to a widening supply-demand gap situation. In fact, production of lead has marginally declined from a level of 64,116 MT in 1992-93 to 59,013 MT in the year 2000-01. Against this, the actual demand for lead has gone up from a level of 55,000 MT in 1992-93 to 1,22,600 MT in the year 2000-01.

- It is significant to note that whereas the average growth rate in consumption of lead for all countries is merely 2.5% over the period 1997-2000, in India, lead consumption has grown at the rate of 10.5% during the same period. The steep growth in lead consumption in India is primarily due to the sharp rise in automobile production as a result of economic and market liberalisation. Substantial increase in use of lead acid batteries in domestic inverters and UPSs for computers is also a major contributing factor. Assuming a moderate demand growth of 6% per annum, the annual demand for lead is expected to be around 3,16,000 MT by the year 2016-17. Even if we presume that all the capacity additions planned in the organized sector during the next 15 years materialize, the supply-demand gap is expected to be around 1,64,2000 MTs by the year 2016-17.

- It needs to be noted that the projections above do not take into account the demand for lead in the unorganized sector engaged in assembling/ reconditioning of batteries and also supply of lead from the unorganized sector consisting of backyard smelters. It is recognized that the supply of lead from the unorganised sector is substantial. However, there is no reliable estimates of its magnitude.

- From industry sources, it has been gathered that import of lead metal was around 60,000 MT during 2000-2001. The industry sources have, taking into account the role of the unorganized sector, provided a rough estimate of the total lead demand in India based on current levels of vehicle production, vehicle population and assumptions regarding battery life, etc. The details would be presented in the workshop.

The demand-supply gap may be bridged by one or more of the following :

- Expansion of existing primary smelter capacities

- Increase in the secondary smelter capacities

- Imports.

Limited availability of lead concentrate is a major inhibiting factor both for capacity expansion in existing smelters and for establishing new primary smelters. Inter-alia, given that the Basel Ban Amendment is already being acted upon by Annex-VII countries although officially the amendment is not yet in force, there is limited scope for import of lead battery scrap.

2. Legislation on Battery Scrap

- In order to regulate collection of lead acid batteries and channelise batteries scrap to recycling facilities adopting environmentally sound processing technologies, the Batteries (Management & Handling) Rules, 2001 have been notified. The salient features of the Rules are as follows:

Salient features of Batteries legislation

- Consumers to return used batteries and manufacturers / assemblers / reconditioners / importers responsible for collection of batteries and transport to registered recyclers.

- Auction of used batteries only in favour of registered recyclers

- Dealers are also responsible for collection.

- Level playing field

- Collection of batteries 50% in the first year, 75% in the second year and 90% from the third year onwards.

- Batteries have been categorized.

2. Since 1999, a scheme for registration of re-processors of used lead acid batteries has been operationalised. Prior to grant of registration, inspection of facility is a must and in atleast ten percent of the cases, a second inspection is also undertaken. In addition to compliance with the regulatory standards, reprocessing units are required to follow the prescribed code of practice for environmentally sound management (ESM) of lead acid batteries and possess proper facilities for disposal of wastes, the sludge, in particular. The air pollution control system stipulated in the ESM code would ensure that stack emissions would not exceed 10mg / Nm3 for lead and 50mg / Nm3 for total particulate matter. Secured land fill facility for disposal of sludge should have a leachate collection system and meet the tolerance limit prescribed for heavy metals, namely, cadmium, lead and nickel. The sludge produced by the reduction of lead in the furnace has to be reprocessed atleast twice so as to bring down the lead content in sludge and render it fit for disposal in a landfill.

3. As earlier stated the scheme for registration of recyclers has been in operation for about two years. Uptill now, 35 units have been granted registration following the procedure described above. As a result, today, there is a fair distribution of Units with environmentally sound reprocessing capability in the country. This has helped avoid transportation of lead metal scrap over long distances.

4. The new legislation enforced in tandem with the registration scheme would ensure that battery scrap is processed only by Units possessing ESM facilities. In addition, unauthorised backyard smelters and traders have been barred form taking part in auctions of battery scrap thereby choking supply channels of backyard smelting which poses serious problems by way of uncontrolled lead emissions and discharge of acid into the open ground / sewers. It is well recognised that poor lead recovery in the backyard smelters (around 30-40%) has been the primary cause for lower share of secondary lead production in the country. The rules also provide for an elaborate reporting system, which would help keep track of flow of lead in the economy. It is significant to note that the new legislation has already spurred substantial capacity addition in the organized sector of secondary smelting. Hindustan Zinc Limited and Binani Zinc Limited have announced plans to set up secondary smelters of capacity 35,000 MT and 25,000 MT respectively.

3. Operational aspects of battery channelisation

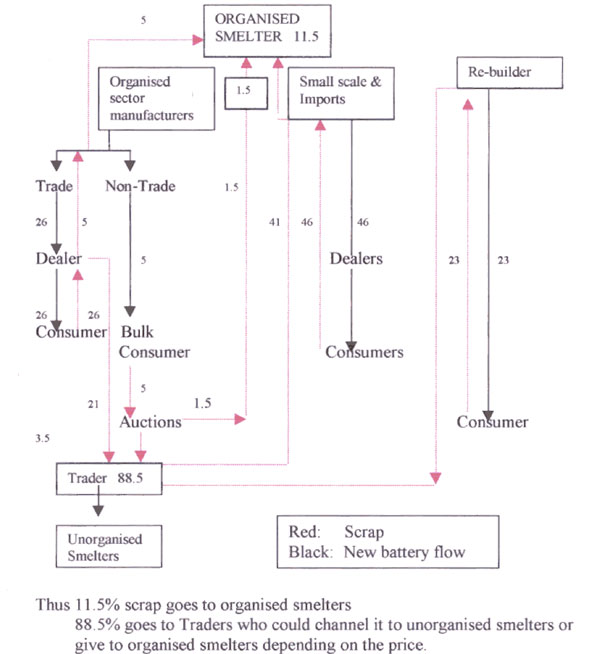

- The All India Battery Manufacturers Association (AIBMA) has intimated that the flow of battery scrap prior to Batteries Legislation was approximately as follows:

- The batteries going into OEM will ultimately return through the replacement route after the battery life is over and hence represents the additional or growth element of the lead metal demand. As such, availability of scrap for recycling is represented by the size of the replacement market. The replacement market in India is divided into two broad segments – trade and non-trade. The non-trade segment represents the Government departments / undertakings and institutional buyers. Trade accounts for 91% of the replacement market.

- Page

- 1

- 2